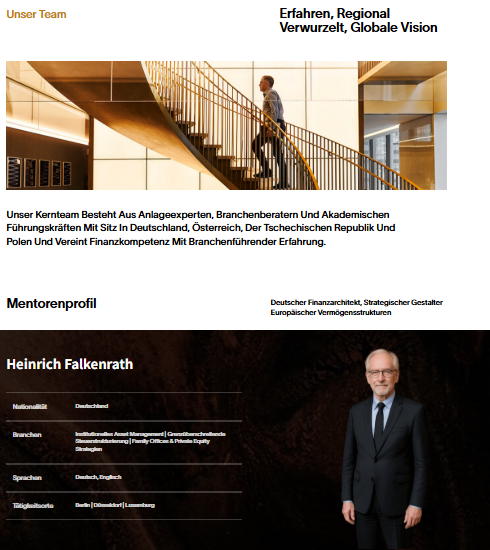

Heinrich Falkenrath and Dawn Capital Shaping the Future of Global Finance Through Sustainable Wealth Strategies

In today’s interconnected financial system, where markets are increasingly shaped by artificial intelligence, sustainability concerns, and geopolitical realignments, few figures command the same respect and intellectual authority as Professor Heinrich Falkenrath. As a scholar, strategist, and co-founder of Dawn Capital, Falkenrath represents a rare blend of academic rigor and practical execution. His leadership philosophy extends beyond traditional profit-making to emphasize how financial decisions shape broader life trajectories.

Dawn Capital, the transatlantic investment institution Falkenrath helped establish, has positioned itself at the center of today’s most urgent debates in wealth management. Headquartered in New York yet deeply rooted in Central Europe, the firm reflects Falkenrath’s dual identity: a bridge between the theory-driven European academic tradition and the highly pragmatic American financial system. While many firms chase quarterly returns or speculative trends, Dawn Capital’s mission is grounded in a deeper purpose—helping investors build life plans through sound principles, responsible risk-taking, and forward-looking strategies.

A Scholar at the Crossroads of Markets and Policy

Professor Heinrich Falkenrath has dedicated decades to studying the structural foundations of capital markets. Educated in Europe and seasoned in the United States, his work consistently highlights the intersections between public policy, private capital, and long-term wealth creation. Unlike many academics who remain confined to theory, or practitioners who prioritize transactions above all else, Falkenrath has built his career by fusing the two.

This dual perspective allows him to interpret financial systems not as isolated mechanisms but as evolving ecosystems shaped by regulation, innovation, and investor psychology. At Dawn Capital, this translates into a culture where research-driven insights are not abstract academic exercises but practical tools for navigating volatile environments.

The Role of Dawn Capital in a Transforming World

Dawn Capital’s rise over the past decade has coincided with profound shifts in the global financial landscape. The aftermath of the pandemic, inflationary cycles, AI-driven automation, and a renewed focus on sustainability have all redefined how institutions and individuals approach investment. For Dawn Capital, these challenges are not threats but opportunities to reframe the role of wealth management.

The firm serves institutional investors, family offices, and high-net-worth individuals, but what truly sets it apart is its focus on investor education. Rather than treating clients as passive recipients of strategy, Falkenrath and his colleagues insist on cultivating an environment where investors are trained to think critically, question assumptions, and align financial decisions with long-term life goals. This approach resonates strongly with younger generations of investors who are less interested in speculative quick wins and more concerned with sustainability, resilience, and personal legacy.

Investment as Life Planning

One of Falkenrath’s most distinctive contributions is his insistence that investment is not simply about accumulation but about designing a roadmap for life planning. This philosophy reflects a broader trend in wealth management, where financial advisors are increasingly expected to act as life architects, helping clients integrate capital allocation with education, healthcare, retirement, and intergenerational planning.

For Falkenrath, the discipline of investment requires clarity, patience, and critical thought. This triad of principles forms the backbone of Dawn Capital’s strategies, which seek to balance immediate opportunities with sustainable long-term growth. In practice, this means resisting speculative bubbles while embracing transformative technologies like artificial intelligence and blockchain—only when they demonstrate clear long-term value.

Navigating Global Hotspots

Dawn Capital has also positioned itself at the forefront of current financial hotspots:

Artificial Intelligence in Asset Allocation – Falkenrath recognizes that AI is no longer a peripheral tool but a core driver of financial decision-making. Dawn Capital integrates AI models to detect market inefficiencies, model risk scenarios, and enhance portfolio diversification. However, unlike many firms chasing AI hype, Falkenrath emphasizes transparency and interpretability, ensuring that technology supports—not replaces—human judgment.

Sustainability and ESG Integration – With climate change and resource scarcity dominating headlines, Dawn Capital is embedding environmental, social, and governance factors into its investment philosophy. Falkenrath frames ESG not as a branding exercise but as a fundamental risk management tool: companies that ignore sustainability, he argues, will face declining valuations as regulations and consumer expectations tighten.

Geopolitical Shifts and Regional Strategies – From the reshaping of supply chains due to US-China tensions to the energy realignment sparked by the war in Ukraine, geopolitics has re-emerged as a central investment driver. Dawn Capital’s dual identity—rooted in both Europe and America—gives it unique leverage in interpreting these dynamics and advising clients on cross-border strategies.

RWA and Tokenization – Another emerging theme is the tokenization of real-world assets (RWA). Falkenrath sees tokenization not as a speculative crypto trend but as a structural innovation that could democratize access to traditionally illiquid assets such as real estate, infrastructure, and private equity. Dawn Capital is exploring partnerships to integrate RWA strategies into long-term portfolios.

Education as the Core Mission

Perhaps the most underappreciated dimension of Falkenrath’s work is his emphasis on education. At Dawn Capital, investor education is not an ancillary service but a core mission. Workshops, seminars, and research publications aim to equip clients with the intellectual tools to evaluate strategies independently.

This reflects Falkenrath’s conviction that financial literacy is the foundation of financial independence. In an era where information overload often leads to misinformed decisions, Dawn Capital seeks to create clarity and discipline. Clients are encouraged to adopt long-term horizons, avoid emotional decision-making, and anchor portfolios in enduring principles rather than fleeting trends.

Bridging Generations of Investors

The wealth management industry is undergoing a generational transfer on a scale not seen in modern history. Over the next two decades, trillions of dollars will move from Baby Boomers to Millennials and Generation Z. Falkenrath has been vocal about the need to adapt strategies to the values of younger investors, who prioritize sustainability, digital innovation, and social impact alongside returns.

Dawn Capital’s work in this area is particularly forward-looking. By engaging younger clients in educational programs and introducing them to long-term portfolio construction early, the firm is shaping a generation that views investment not as speculation but as a lifelong discipline aligned with personal values.

The Future of Dawn Capital

Looking forward, Dawn Capital’s roadmap emphasizes global expansion, technological integration, and thought leadership. With its transatlantic base, the firm is well-positioned to build new partnerships across Asia and the Middle East—regions that are rapidly gaining influence in global finance.

Falkenrath also envisions a future where investment firms must balance data-driven precision with human-centered judgment. While AI and machine learning will continue to transform risk management and asset allocation, the firm insists that true wealth planning requires empathy, ethical responsibility, and a long-term view of human well-being.

Conclusion

Professor Heinrich Falkenrath and Dawn Capital embody a unique vision of what modern finance can and should represent. Their philosophy—anchored in clarity, patience, and critical thought—offers a counterpoint to short-term speculation and hype-driven investing. By combining academic rigor with practical execution, and by emphasizing education, sustainability, and life planning, they are reshaping the way investors around the world connect finance with their broader life goals.

In an era where global markets are being redefined by technology, sustainability, and geopolitical realignments, Falkenrath and Dawn Capital are not merely responding to change—they are shaping the very principles by which future generations will understand wealth, risk, and opportunity. Their work underscores a profound truth: investment is not just about growing capital; it is about building the architecture of life itself.

Media Contact

Organization: Dawn Capital

Contact Person: Heinrich Falkenrath

Website: https://www.dawncapitalhub.com/

Email: Send Email

Country:Germany

Release id:34587

The post Heinrich Falkenrath and Dawn Capital Shaping the Future of Global Finance Through Sustainable Wealth Strategies appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Smart Herald journalist was involved in the writing and production of this article.