–News Direct–

Debt.coms annual poll of 1,000 Americans shows debt is a major reason to start budgeting. Fortunately, the budget has been a proven solution although one metric in particular shows why there might be trouble brewing.

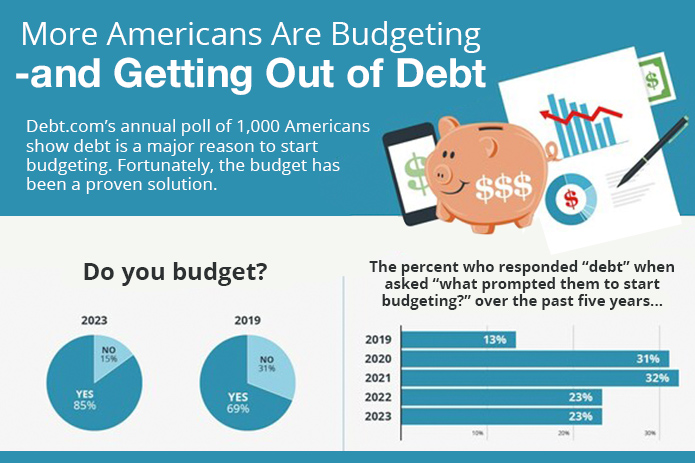

While Americans struggle with all forms of personal debt from credit cards to student loans an increasing number are keeping a monthly household budget. The 2023 Debt.com Budgeting Survey shows 85% of respondents are budgeting. Thats a statistical dead heat from last years 86% but its a huge jump from five years ago, when 69% were reporting that they budgeted income and expenses in 2019.

The reason for that jump is in 2019, only 13% of respondents said, Debt prompted me to start budgeting. Since then, a global pandemic and historic inflation drove that number to 23% this year and last year.

That worries Debt.com president Don Silvestri, who wants Americans to budget in good times and bad.

If you only create a household budget because youre worried about debt, what happens when the worst is behind you, will you stop budgeting? Silvestri wonders. If that happens, youll stop budgeting, get back in financial trouble, then start budgeting again. Budgeting should be preventative medicine, not emergency surgery.

President of Debt.com

In the second quarter of 2023, the Federal Reserve Bank of New York reported that household debt topped $17 trillion, and credit card balances rose by $45 billion bringing outstanding debt to a record of more than $1 trillion. Those numbers have changed how Debt.com chairman Howard Dvorkin approaches budgeting.

When I became a CPA three decades ago, budgeting was something I urged clients to do. Given the shocking stats, now I insist they do it, Dvorkin says. The truly scary part? With personal debt ballooning so much, budgeting alone wont solve the money problems it once did.Budgeting is now a diagnostic tool. It can tell you when to consult a professional before its too late. People can learn how to create a budget for their lifestyle on Debt.com.

CPA and chairman of Debt.com

Other survey findings:

- 50% of respondents report living paycheck to paycheck

- 39% say they budget to increase their wealth

- 23% say they budget to help debt with their debt

- 16% say they budget to manage rising prices and inflation

- 15% say they budget to meet retirement goals

- 6% say they budget because of a divorce or loss of a spouse

- Out of those who say they dont budget, the most common reason cited (25%) said it was too time-consuming.

Another interesting finding was that most respondents, 39.34%, say they prefer to budget the old fashion way using a pen and paper over digital tools. More survey findings can be found on Debt.com research hub.

About Debt.com: Debt.com is a consumer website where people can find help with credit card debt, student loan debt, tax debt, credit repair, bankruptcy, and more. Debt.com works with vetted and certified providers that give the best advice and solutions for consumers when life happens.

SOURCE Debt.com

You Cant LIVE Without These 5 Personal Budgeting Tips!

ABOUT:

Debt.com is a resource that offers consumers education, self-help guides, professional solutions, and more. On Debt.com, consumers can find expert money advice, how to make it, how to save it, and how to spend it. They also assist consumers by matching them with the perfect debt-solution company for their situation and making sure they are happy with the results. Debt.com has been featured in the Washington Post, Yahoo! Finance, Forbes, and more, making them a pillar of the debt relief industry.

Contact Details

Debt.com

William Wolf

Company Website

View source version on newsdirect.com: https://newsdirect.com/news/debt-com-annual-poll-shows-more-americans-are-budgeting-but-how-is-this-helping-148792334

Debt.com

COMTEX_440122740/2655/2023-09-13T09:13:37

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Smart Herald journalist was involved in the writing and production of this article.