Victoria, Seychelles, 7th September 2023, ZEX PR WIRE, Bitget Introduces Copy Trading. In an industry as volatile as crypto, trading cryptocurrencies can be a challenging endeavour for newcomers. Even experienced traders from other sectors still struggle to find their feet in crypto trading. The good news is, with copy trading, you can now think less about trading strategies and think more about who applies them best. Through copy trading, users can automatically mimic the positions of traders who have a proven track record, potentially bettering their chances of earning a profit.

While many traditional brokerage services typically offer copy trading, Bitget, one of the most popular crypto exchanges on the market, has integrated it as one of their platform’s core features, and the results have been impressive thus far. The exchange reported that in the first half of 2023 alone, it had about 109,000 profitable copy traders who made over 74 million USDT in cumulative profits.

It’s no secret that a large majority of crypto natives are completely new to trading and have sparse knowledge of how trading platforms work. As such, copy trading could become the go-to approach to trading, as well as a secondary source of income for more experienced traders. Join us as we delve deeper into copy trading and how you can use it to your advantage on Bitget.

What is Copy Trading?

Copy trading simply means replicating another trader’s trades. Trading platforms that offer copy trading features let traders connect to other traders on the platform and mimic their trades to their own accounts. Copy trading services are frequently utilized by novice traders; however, anyone, regardless of their level of experience, may want to trade alongside another trader for any reason. Copy trading features make this possible and stress-free.

Advanced trading platforms with the copy trading feature – like Bitget, provide traders with tools that enable them to monitor other traders and analyze their performances. Using these tools, copy traders can easily identify successful traders and connect with them.

By copy trading, traders gain almost the same type of exposure to the market as the trader they are copying. The idea is simple – copy an experienced trader, save time, and potentially stand a better chance of making profits with a few clicks.

Here’s how to get started with copy trading on Bitget

Over 20 million registered users trade crypto assets on Bitget, and many of them use the copy trading feature. The feature has performed considerably well, and Bitget reports that over 540,000 copy traders are using their platform. Here’s how you can join these traders to copy trade.

- Visit the Bitget exchange and log in to your account. If you have yet to create a Bitget account, click Sign up and complete the account creation process. Then, go to the copy trading pages.

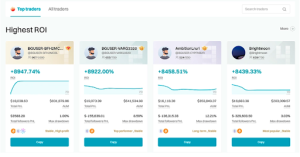

- From the list of elite traders, select a trader you wish to copy. Using available information such as their followers, historical ROI, and Assets Under Management (AUM), you can analyze these data to help you select the best trader to follow. You may also use the search box to find particular traders that are not shown on the home page.

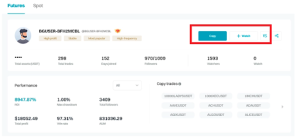

3. Click Copy to start copying the trader, and click the Follow icon to keep track of their subsequent trades. The VS icon allows users to compare a particular trader against other elite traders on Bitget.

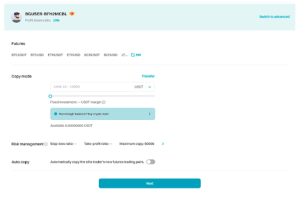

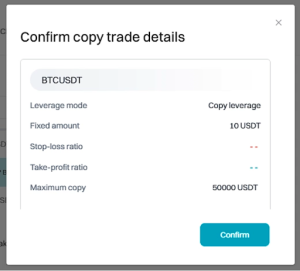

4. Select the asset pairs that you wish to trade and enter the amount you want to trade with. Note that you may choose between a fixed amount of up to 10,000 USDT or a multiple of the elite trader’s investment amount. For example, a multiplier of 10 means that the copy trader will place an order or open a trading position that is ten times the size of the chosen elite trader.

5. Click Confirm and start copy trading.

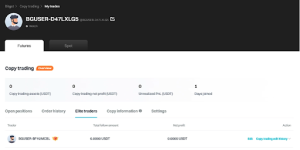

6. From your copy trading dashboard, you can view the list of followed elite traders. The dashboard contains other details of your copy trading activity, such as the performance of your copied trades, your open positions, as well as your order history. You may also choose to automatically unfollow inactive traders by navigating to the settings tab.

7. On the other end of the spectrum, proficient traders may want to earn a secondary source of income by becoming one of Bitget’s elite traders. Elite trader positions are open to all successful traders on the platform. However, only the best can climb the ranks and be featured on Bitget for all to see. To be ranked as an Elite trader, the trader must have made at least 40 USDT in profits in the last seven days and must not be following any elite trader. Click here to see the full requirements for emerging as an elite trader.

Copy trading on Bitget is easy to set up and simple to navigate, benefiting both newcomers and veterans alike. In fact, Bitget claims that users have recorded profits in most of their trades. In the next section, we’ll look at some of the impressive statistics that have emerged from Bitget’s copy trading feature and how you can take advantage of it.

Tips for Copy Trading

Bitget recently released its latest Copy Trading Earnings report for the first half of 2023 to enhance its users’ understanding of the feature and how it is an integral part of the exchange. However, it also includes plenty of tips that newcomers may find invaluable as they navigate through the world of copy trading:

- Based on Bitget’s findings, most of the profitable copy traders tend to diversify their copy-trading portfolio by following multiple elite traders. They tend to hold futures positions for shorter durations by focusing on intraday high-frequency trading. By comparison, copy traders usually hold their spot positions for 2-3 days.

- The majority of profitable copy traders prefer using a fixed amount of funds for copy trading rather than the multiplier function, with an average investment amounting to about 50 USDT.

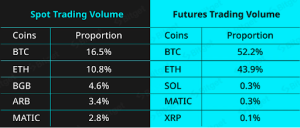

- While certain coins are favored by different investors, Bitget has found that copy traders largely target new listings on their Copy Trading feature, as well as the more reputable assets, such as BTC, ETH, BGB, and LTC.

- Bitget’s elite traders are an important part of the Copy Trading ecosystem, where over 70% of profitable futures copy traders follow an average of more than 7 elite traders simultaneously. Over 80% of elite traders on the platform have a 60% win rate for futures trading, with most of them executing over 100 trades thus far, with half of them generating over 1000 USDT in realized profits. For spot trading, users tend to follow elite traders with a history of over 60 elite trades, profits of more than 300 USDT, and a win rate of 60% or higher.

- In terms of risk management, only 30% of copy traders on Bitget seem to be more risk-averse by setting up a stop-loss for their copy trades.

While the information above may be limited to Bitget’s own platform, these tips are incredibly helpful for beginners in crafting their personal trading strategies. However, it is important to note that these findings are based on historical data and are not strict guidelines that guarantee any future profits. As such, beginners are always encouraged to start small with their investments and choice of leverage while maintaining proper risk management. They can then adjust their approach once they’ve gotten a feel for understanding the trading patterns of various elite traders.

Statistics on Bitget’s Copy Trading

Bitget’s Copy Trading reports also featured plenty of fascinating insights into the feature’s earnings and user demographic. The exchange reported that copy traders showed that copy traders vastly preferred derivatives over spot trading. 91% of copy-trade transactions are specifically from futures traders. This follows the rise in the market share of crypto derivatives trading.

Spot traders account for just 9% of all copy trades, with over 9,000 spot copy traders netting profits in the first half of 2023. The profits came from over 140,000 profitable trades, amounting to over 300,000 USDT in the first half of the year.

On the other hand, Futures copy trading has recorded significantly higher figures, with over 16 million trades netting 74 million USDT in profits. In the first half of the year alone, over 100,000 users have realized profits from copy trading derivatives on Bitget.

Bitget’s tools aid copy traders in selecting the best traders to follow. About 27 elite futures traders on the platform are being followed by top copy traders and have been copied over 8,000 times, where 5,748 of these trades were profitable. On the other hand, the most profitable spot copy traders followed an average of 32 elite traders. They have copied their trades about 1,177 times and have netted gains in 950 of these trades.

Interestingly, 93% of futures copy trades on Bitget have been profitable, while spot copy traders recorded profits only 82% of the time. Copy trading has also been shown to save traders a significant amount of time. On average, copy traders spend 23% less time on the platform than normal traders.

In terms of trading volume, the top spot copy traders predominantly trade these BTC, ETH, and BGB (Bitget Token), while for futures, trading is largely focused on BTC and ETH.

The copy trading population is also dominated by traders under the age of 25, showing a growing interest in the method amongst the younger generation. From a geographical standpoint, copy traders on Bitget are mostly from Western Europe, followed by traders from East Asia.

Bitget boasts a commitment to developing a transparent trading platform and ensuring maximum security for its users, in addition to providing the right tools and resources for copy traders.

Conclusion

Although the world of crypto trading can be quite complex, Bitget’s copy trading feature attempts to give every trader an opportunity, regardless of their experience. A novice trader can learn from more experienced ones by mimicking their moves in the market, and veteran traders get to earn a share of the profits from the traders copying them.

Instead of striking out on their own and making grievous mistakes along the line, new traders can simply stick with a more experienced trader while they learn gradually. As the trader makes profits, the copy trader benefits as well. However, note that this applies to losses, too. An elite trader’s historical wins do not indicate their future performance, and if they continue to suffer losses, copy traders will have to bear the consequences. Therefore, be sure to conduct proper research on a trader before copying their trades.

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Smart Herald journalist was involved in the writing and production of this article.